Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

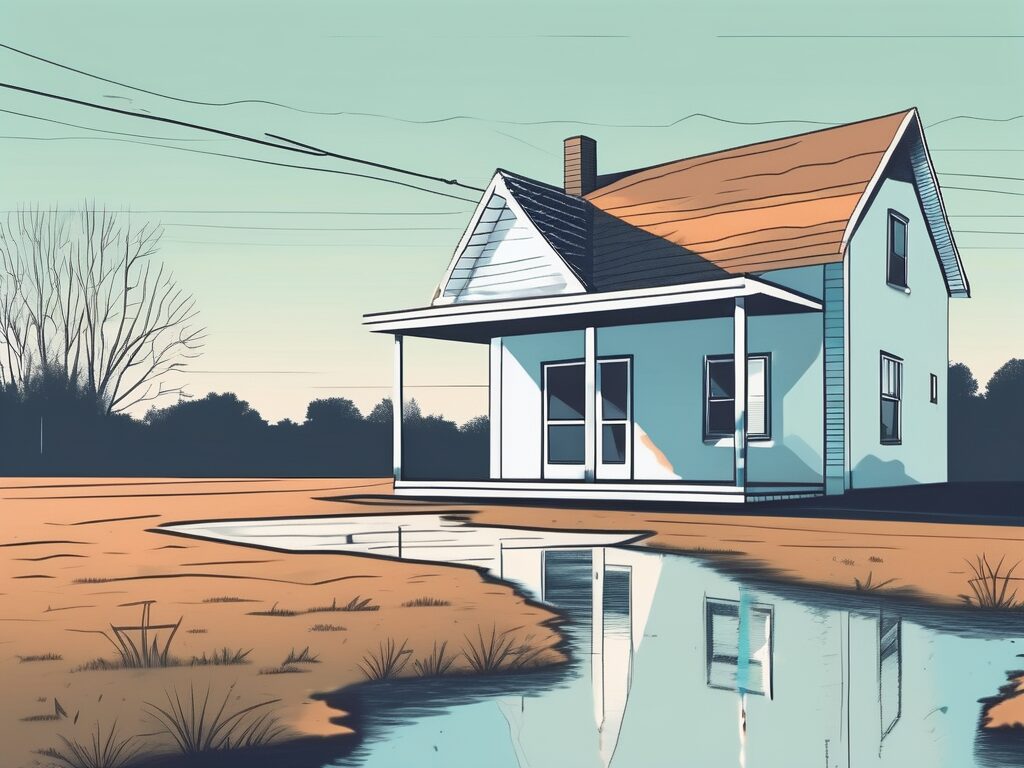

If you are a homeowner who has experienced the devastating effects of flooding, you may find yourself in the difficult position of needing to sell your flood-damaged house. Selling a flood-damaged house comes with its own unique challenges, but with the right knowledge and strategies, you can successfully navigate this process. In this step-by-step guide, we will walk you through the necessary steps to sell your flood-damaged house and maximize its selling potential.

Before delving into the steps of selling a flood-damaged house, it is essential to understand the impact that flooding can have on property value. Flooding can cause significant structural damage, compromising the integrity of the house. Additionally, the potential for mold growth and other health hazards can further devalue the property. It is crucial to have a realistic understanding of how flooding affects property value in order to set appropriate expectations when selling your flood-damaged house.

Flooded houses typically experience a decrease in value due to the damage caused by the flooding. The extent of the devaluation depends on various factors, including the severity of the flood, the type of water that entered the house, and the steps taken to remediate the damage. Generally, potential buyers are hesitant to purchase flood-damaged houses, which can lead to longer selling periods and lower offers.

When a house is affected by flooding, the structural integrity is compromised. The force of the water can weaken the foundation, walls, and other supporting structures. This damage not only affects the stability of the house but also raises safety concerns for potential buyers. The cost of repairing and reinforcing the structure can be substantial, further reducing the property’s value.

In addition to structural damage, flooding often leads to the growth of mold and other harmful microorganisms. When water enters a house, it creates a moist environment that promotes mold growth. Mold can cause various health issues, including respiratory problems and allergies. The presence of mold in a flood-damaged house can be a significant deterrent for potential buyers, as it poses a risk to their well-being. Therefore, the devaluation of a flooded house takes into account not only the physical damage but also the potential health hazards associated with mold growth.

One of the first decisions you need to make when selling a flood-damaged house is whether to repair the property before listing it or sell it as-is. Several factors should be taken into account when making this decision, such as the cost of repairs, the timeline for completing them, and the potential return on investment. Consulting with a professional, such as a real estate agent or contractor, can provide valuable insights to help you weigh your options effectively.

The cost of repairs is a crucial factor to consider. Assessing the extent of the damage and obtaining repair estimates from reputable contractors can give you a clear idea of the financial implications. Depending on the severity of the flood, the cost of repairs can range from minor cosmetic fixes to extensive renovations. It is important to evaluate whether the potential increase in property value after repairs justifies the investment.

Another consideration is the timeline for completing the repairs. Selling a flood-damaged house can be time-sensitive, especially if you need to relocate or if the property is in an area prone to frequent flooding. Assessing the time it would take to complete the repairs and comparing it to your desired selling timeline is essential for making an informed decision.

Lastly, the potential return on investment should be evaluated. Researching the real estate market in your area and consulting with a real estate agent can help you determine the potential selling price of a fully repaired house compared to the current market value of flood-damaged properties. This analysis will give you an idea of the potential profit or loss you may incur by investing in repairs.

Ultimately, the decision to repair or sell a flood-damaged house depends on your specific circumstances and goals. Taking into account the cost of repairs, the timeline, and the potential return on investment will help you make an informed choice that aligns with your needs.

Selling a flood-damaged house can be a daunting task, but with careful planning and execution, it is possible to navigate the challenges and successfully sell your property. By following these seven essential steps, you can increase your chances of attracting potential buyers and closing a deal:

When selling a flood-damaged house, seeking expert advice from a local real estate agent who specializes in such properties can be highly beneficial. These agents have in-depth knowledge of the local market and can provide valuable insights into pricing, marketing, and negotiating. They can also guide you through the complexities of selling a flood-damaged house, ensuring a smoother and more successful transaction.

Disclosing flood damage is not only an ethical responsibility but also a legal requirement in many jurisdictions. It is essential to familiarize yourself with the specific laws and regulations in your area regarding flood damage disclosure. By complying with these legal requirements, you protect yourself from potential legal issues and maintain your integrity as a seller.

While it may not be feasible to completely restore a flood-damaged house, making strategic improvements can significantly increase its selling potential. Focus on repairs and renovations that will enhance the functionality and aesthetics of the house. This may include fixing water damage, replacing flooring, updating the kitchen and bathrooms, or improving the curb appeal. By investing in these improvements, you make your property more attractive to potential buyers and increase its overall value.

Pricing a flood-damaged house can be a challenge, as you need to consider the impact of flood damage on its value. Consulting with a real estate agent or appraiser who has experience with flood-damaged properties can help you determine an appropriate selling price. They will consider factors such as the extent of the damage, the quality of repairs, and the current market conditions to arrive at a fair and competitive price. By acknowledging the impact of flood damage on pricing, you set realistic expectations and attract serious buyers.

When selling a flood-damaged house, it is crucial to organize all the necessary documentation related to the flood damage, repairs, insurance claims, and any remediation efforts undertaken. Having comprehensive documentation readily available instills confidence in potential buyers and demonstrates your commitment to transparency. This documentation can also facilitate a smoother selling process by providing buyers with the information they need to make informed decisions.

If you are in a hurry to sell your flood-damaged house or prefer a hassle-free transaction, exploring the option of selling to an investor may be worth considering. Investors often specialize in purchasing distressed or damaged properties and can provide a quick and convenient solution for selling your flood-damaged house. However, it is essential to carefully evaluate any offers received and ensure that the terms align with your goals and expectations.

While the focus of this guide is on selling a flood-damaged house, it is important to address immediate steps you should take to minimize flood damage to your property. These steps include:

When it comes to minimizing flood damage to your house, swift action is crucial. The longer the water remains stagnant, the more extensive the damage can become. Therefore, it is essential to take immediate steps to address the situation.

One of the first and most important steps is to ensure the safety of yourself and your family. In the event of a severe flood, it may be necessary to evacuate the premises. Your well-being should always be the top priority. Additionally, turning off the electrical power can help prevent accidents and further damage to your property.

Once everyone is safe, it is crucial to contact professionals specializing in flood damage restoration. These experts have the knowledge, experience, and equipment to mitigate the damage and prevent further deterioration of your house. Their prompt response can make a significant difference in the restoration process.

While waiting for the professionals to arrive, it is essential to document the flood damage. Take detailed photographs and videos of the affected areas. These visual records will serve as valuable evidence for insurance purposes. It is crucial to file an insurance claim as soon as possible to expedite the reimbursement process.

After documenting the damage, the next step is to dry out the property. Standing water can lead to mold growth, structural damage, and other issues. Use pumps, wet vacuums, or any other suitable equipment to remove the water. Additionally, ensure proper ventilation and use dehumidifiers to dry the house thoroughly.

While drying out the property, it is also important to remove any damaged items. Items that cannot be salvaged or repaired due to the flood damage should be disposed of properly. This will prevent further contamination and potential health hazards.

Remember, these immediate steps are crucial in minimizing flood damage to your house. By taking swift action and involving professionals, you can mitigate the effects of the flood and protect your property from further deterioration. Stay proactive and prioritize safety to ensure the best possible outcome in this challenging situation.

When selling a flood-damaged house, home inspections play a crucial role in the selling process. Home inspectors evaluate the condition of the property, including any flood damage, and provide a detailed report to potential buyers. This report is essential as it helps buyers understand the extent of the damage and make an informed decision.

During a home inspection, the inspector will carefully examine the interior and exterior of the house. They will look for visible signs of flood damage, such as water stains on walls or ceilings, warped floors, or mold growth. Additionally, they will inspect the foundation, plumbing, electrical systems, and HVAC to ensure they are functioning properly.

It’s important for sellers to be present during the home inspection to answer any questions the inspector may have. This is an opportunity to provide additional information about the flood damage, such as the cause of the flooding and any repairs that have been made. Transparency is key in building trust with potential buyers.

During the home inspection, potential buyers may have specific questions regarding the flood damage and its impact on the property. Be prepared to address common questions about flood damage repairs, warranties, and insurance coverage to provide potential buyers with the information they need to make an informed decision.

One common question buyers may ask is whether the flood damage has been fully repaired. It’s important to provide documentation of any repairs that have been done, including receipts from contractors or insurance claims. This will give buyers confidence that the necessary repairs have been made and the property is in good condition.

Buyers may also inquire about warranties for the repairs. If any warranties are in place, such as for a new sump pump or waterproofing system, make sure to provide the details to potential buyers. This can give them peace of mind knowing that they will be covered in case of any future issues related to the flood damage.

Another important aspect buyers may be concerned about is insurance coverage. They may want to know if the property is eligible for flood insurance and what the premiums would be. If the property is located in a flood-prone area, it’s important to have this information readily available to address any concerns buyers may have.

While this guide primarily focuses on selling a flood-damaged house, many of the strategies and tips mentioned can also be applied to selling a house with fire damage. It is essential to consider the unique challenges associated with fire damage and take appropriate steps to maximize the value of your property.

When selling a house with fire damage, it’s crucial to hire professionals who specialize in fire restoration to assess the property. They can provide an accurate evaluation of the damage and recommend the necessary repairs. It’s important to disclose the extent of the fire damage to potential buyers and provide documentation of the restoration work that has been done.

In addition to repairs, staging the house can also help maximize its value. Professional staging can help potential buyers visualize the potential of the property and create a more appealing atmosphere. It’s important to focus on highlighting the positive aspects of the house and downplaying the fire damage.

By following this step-by-step guide, you can navigate the process of selling your flood-damaged house with confidence. While it may present challenges, with the right knowledge and strategies, you can successfully sell your flood-damaged house and move forward in your homeownership journey.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call