Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

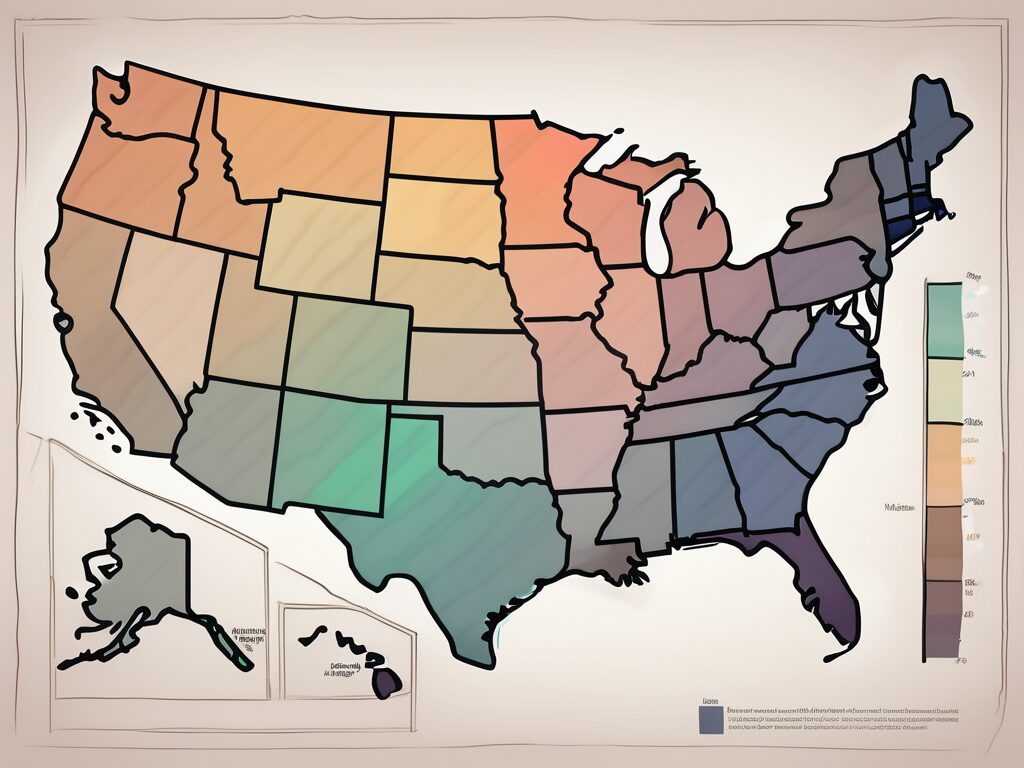

In the world of mortgage refinancing, understanding the approval rates across different states can provide valuable insights for homeowners looking to refinance their homes. With fluctuating interest rates and varying economic conditions, it is crucial to examine how different states fare when it comes to mortgage refinance approval rates. This article aims to uncover important insights and shed light on the top states for mortgage refinance approval, as well as the challenges some states face.

When examining the overall landscape of mortgage refinance approval rates, several key findings emerge. It is fascinating to see how certain states consistently rank high in approval rates, while others struggle to secure favorable outcomes. By exploring these insights, homeowners can make more informed decisions about where to pursue refinancing options.

One of the noteworthy revelations is the presence of certain states that consistently rank among the top in terms of mortgage refinance approval rates. These states have implemented policies and have economic conditions that make refinancing a more accessible option for homeowners.

Among these top-performing states is South Dakota. With its strong economy and a mortgage-friendly environment, South Dakota takes the lead in mortgage refinance approval rates. Homeowners in this state enjoy favorable conditions, including low interest rates and accessible refinancing options.

Utah is another state that stands out in terms of mortgage refinance approval rates. With a growing economy and a robust housing market, it ranks high in providing homeowners with opportunities to refinance their homes. Utah’s favorable approval rates can be attributed to its stable economic conditions and low unemployment rates.

North Dakota also secures a spot among the top states for mortgage refinance approval. Despite its relatively smaller population, North Dakota offers homeowners favorable conditions for refinancing, including low interest rates and a supportive lending environment.

Another state that homeowners should consider when looking for mortgage refinance options is California. With its diverse economy and a booming real estate market, California provides homeowners with a range of opportunities to refinance their mortgages. The state’s high approval rates can be attributed to its strong job market and the presence of numerous lending institutions.

Moving to the East Coast, New York emerges as a state with favorable mortgage refinance approval rates. With its bustling financial sector and a large population, New York offers homeowners a competitive refinancing market. The state’s robust economy and access to various financial services contribute to its high approval rates.

Heading down south, Texas also deserves recognition for its mortgage refinance approval rates. The Lone Star State’s thriving economy and affordable housing market make it an attractive destination for homeowners looking to refinance. Texas’s favorable approval rates can be attributed to its low cost of living and a strong job market.

As we explore the landscape of mortgage refinance approval rates, it becomes clear that certain states have positioned themselves as leaders in providing homeowners with favorable refinancing options. Whether it’s the strong economies, low interest rates, or supportive lending environments, these states offer homeowners the opportunity to make the most of their refinancing decisions.

While some states excel in mortgage refinance approval rates, others face significant hurdles that hinder homeowners from pursuing refinancing options. Understanding these challenges is crucial for homeowners who find themselves in states where refinancing may be more difficult to achieve.

One state that experiences challenges in mortgage refinance approval rates is Florida. This vibrant and popular destination faces unique hurdles due to its robust housing market and high population density. The demand for refinancing often exceeds the available resources, resulting in lower approval rates compared to some other states.

Florida’s housing market is known for its diversity, with a wide range of property types available, from luxurious beachfront condos to suburban family homes. However, this diversity also poses challenges when it comes to mortgage refinance approvals. Lenders must carefully assess the value and condition of each property, taking into account factors such as location, market trends, and potential risks.

Additionally, Florida’s high population density adds another layer of complexity to the refinancing process. With a large number of homeowners seeking to refinance their mortgages, lenders face a significant workload, leading to longer processing times and potentially lower approval rates.

Another state that faces challenges in the refinancing process is New York. With its highly competitive housing market and complex financial landscape, homeowners in New York often encounter difficulties in obtaining mortgage refinance approvals. Factors such as high property values and strict lending regulations contribute to the lower approval rates.

New York’s housing market is notorious for its high property values, especially in popular areas like Manhattan and Brooklyn. While this may be beneficial for homeowners in terms of property appreciation, it can make refinancing a more challenging endeavor. Lenders need to carefully evaluate the value of properties and ensure that the loan amount aligns with the property’s worth.

Furthermore, New York’s financial landscape adds another layer of complexity to the refinancing process. The state’s strict lending regulations aim to protect both lenders and borrowers, but they can also make it more difficult for homeowners to meet the requirements for mortgage refinance approval. Factors such as credit scores, debt-to-income ratios, and employment history play a significant role in the decision-making process.

Connecticut has also experienced low mortgage refinance approval rates in recent years. Despite its affluent reputation, homeowners in this state face challenges due to high property values and stringent lending regulations. Homeowners seeking to refinance their mortgages in Connecticut may encounter difficulties and longer processing times compared to other states.

Connecticut’s housing market is known for its upscale properties and desirable neighborhoods. However, these high property values can make it more challenging for homeowners to meet the loan-to-value requirements set by lenders. Additionally, lenders need to carefully evaluate the market conditions and property values in Connecticut to ensure that the refinanced mortgage aligns with the property’s worth.

Moreover, Connecticut’s stringent lending regulations add another layer of complexity to the refinancing process. The state has implemented strict guidelines to protect both lenders and borrowers, ensuring responsible lending practices. While these regulations are beneficial in maintaining a stable housing market, they can also make it more difficult for homeowners to secure mortgage refinance approvals.

It is paramount to understand the methodology behind the research that reveals these mortgage refinance approval rates across different states. The data used to determine the rates is collected from reputable lending institutions and mortgage refinancing companies. The research involves an in-depth analysis of approval rates, taking into account factors such as interest rates, economic conditions, housing market trends, and lending policies on a state level.

This comprehensive research aims to provide homeowners with valuable insights into the mortgage refinance landscape, allowing them to make informed decisions about pursuing refinancing options. By understanding the approval rates and challenges across different states, homeowners can navigate the refinancing process more effectively, maximizing their chances of securing favorable outcomes.

When it comes to determining mortgage refinance approval rates, the research methodology follows a meticulous process. First, a team of experts gathers data from various lending institutions and mortgage refinancing companies across the country. This data is carefully selected to ensure its reliability and accuracy.

Once the data is collected, it undergoes a rigorous analysis. The researchers delve into the intricacies of each state’s lending policies, studying the fine print and understanding the nuances that can impact approval rates. They also examine the prevailing economic conditions, as well as the interest rates prevalent in each state. This comprehensive approach ensures that the research captures a holistic view of the mortgage refinance landscape.

Furthermore, the research takes into consideration the housing market trends in each state. Factors such as property values, market stability, and demand for refinancing play a crucial role in determining approval rates. By analyzing these trends, the researchers can identify patterns and correlations that shed light on the varying conditions homeowners face when seeking to refinance their homes.

The research methodology also incorporates a comparative analysis of the approval rates across different states. This allows homeowners to gain insights into the states that consistently rank high in approval rates, indicating favorable conditions for refinancing. Conversely, it highlights the challenges faced by homeowners in states with lower approval rates, providing valuable information on the potential obstacles they may encounter.

In conclusion, the mortgage refinance approval rates across different states offer a glimpse into the varying conditions homeowners face when seeking to refinance their homes. While some states consistently rank high in approval rates, others encounter challenges that affect homeowners’ ability to secure refinancing options. By examining these insights and understanding the research methodology used, homeowners can make educated decisions about pursuing refinancing opportunities that best suit their needs and aspirations.

As you consider the insights on mortgage refinance approval rates across different states, remember that the value of your home plays a pivotal role in the refinancing process. Richr is here to assist you with a complimentary home valuation, giving you the power to navigate the market confidently. Whether you’re looking to list your property FSBO or simply want to understand your home’s worth, Richr’s platform connects you to consumer portals and MLS to maximize your visibility. Ready to take the next step? Call Richr on 844-957-4247 for your free Comparative Market Analysis (CMA) and unlock the potential of your property today.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call