Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

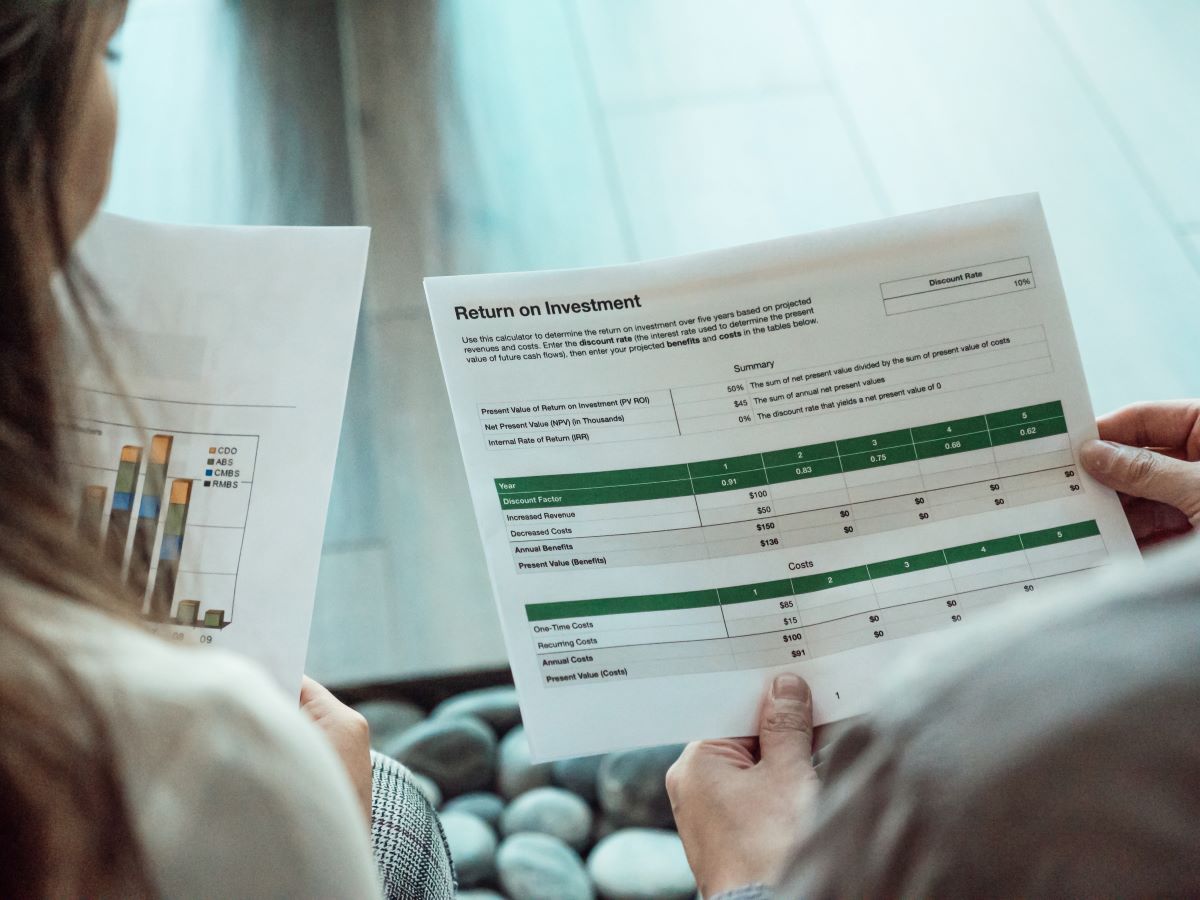

Have you recently sold your home or are considering selling it? Congratulations! Selling a property can provide you with a substantial amount of money to invest and grow your wealth. However, it’s crucial to make informed decisions when it comes to managing the proceeds from your home sale.

In this comprehensive guide, we will explore how you can strategically build your investment portfolio using the funds from your home sale. From understanding different investment options to implementing effective strategies, we’ll cover everything you need to know to make the most of your newfound financial resources.

Selling your home provides a unique opportunity to leverage the funds from the sale and potentially generate significant returns through strategic investing. Rather than letting the money sit idle, building an investment portfolio allows you to put your capital to work and increase your wealth over time.

Investing can provide several benefits, including:

When you sell your home, you receive a lump sum of money that can act as a catalyst for your financial future. However, it’s essential to approach this windfall with careful consideration and a strategic mindset. By taking the time to plan and implement an investment strategy, you can maximize the potential of your home sale proceeds and work toward achieving your financial goals.

In the following sections, we will delve into the key factors you need to consider and the steps you should take to build a successful investment portfolio using your home sale proceeds.

Before diving into the specifics of investment options and strategies, it’s essential to have a clear understanding of your financial goals. What are you looking to achieve with the proceeds from your home sale? Do you have specific short-term objectives, such as paying off debts or funding a child’s education? Are you aiming for long-term financial security or planning for retirement?

Defining your financial goals will help shape your investment strategy. It’s crucial to set realistic and measurable targets to track your progress effectively. Whether you’re looking for income generation, capital appreciation, or a combination of both, understanding your goals will guide your investment decisions.

Risk tolerance and time horizon are two critical factors to consider when building your investment portfolio. Your risk tolerance refers to your ability to endure market fluctuations and tolerate potential losses. It’s essential to assess your comfort level with risk to ensure your investment strategy aligns with your financial temperament.

Additionally, your time horizon plays a crucial role in determining the appropriate investment approach. If you have a long time horizon, you may be able to take on more risk and invest in assets with higher growth potential. Conversely, a shorter time horizon may necessitate a more conservative approach to preserve capital.

By understanding your risk tolerance and time horizon, you can establish an investment strategy that suits your personal circumstances and financial aspirations.

After selling your home, you will have a significant amount of capital to allocate toward your investment portfolio. Before making any investment decisions, it’s crucial to evaluate the actual amount you have available for investment purposes. Consider factors such as transaction costs, real estate agent fees, legal fees, and any outstanding mortgage balances that need to be settled.

By having a clear picture of the actual funds at your disposal, you can avoid overcommitting or underutilizing your resources when building your investment portfolio.

In addition to assessing the funds from your home sale, it’s essential to evaluate your existing debts and financial obligations. Consider any outstanding loans, credit card debt, or other financial responsibilities you need to address. By taking care of high-interest debts first, you can free up additional funds for investment purposes.

It’s important to strike a balance between paying off debts and investing. While reducing debt is generally beneficial, it’s also essential to make your money work for you and take advantage of potential investment opportunities. A comprehensive assessment of your current financial situation will help you determine how much of your home sale proceeds can be allocated towards investments while still managing your obligations responsibly.

When building an investment portfolio with your home sale proceeds, diversification should be a top priority. Diversifying means spreading your investments across different asset classes, industries, and geographical regions. This approach helps mitigate risk and reduces the impact of any single investment’s performance on your overall portfolio.

The benefits of diversification include:

To achieve proper diversification, it’s important to allocate your assets across different investment classes. Here are some common investment classes you can consider:

By allocating your assets across different investment classes, you reduce the risk of significant losses while potentially capitalizing on the growth opportunities offered by each asset class.

Stocks and bonds are two of the most common investment options. Understanding how they work and their pros and cons will help you make informed decisions when building your investment portfolio.

Stocks: Stocks represent ownership in a company and provide investors with the opportunity to participate in the company’s growth and profitability. They can be classified into different categories, including large-cap, mid-cap, small-cap, and international stocks. Stocks have the potential for capital appreciation and dividend income, but their value can fluctuate significantly based on market conditions and the performance of the underlying company.

Bonds: Bonds are debt securities issued by governments, municipalities, or corporations. When you invest in bonds, you lend money to the issuing entity in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are generally considered lower risk than stocks, but their returns are usually more modest. The risk and return profile of bonds can vary based on factors such as the creditworthiness of the issuer, the term to maturity, and prevailing interest rates.

Both stocks and bonds offer different advantages and risks, and a well-diversified portfolio often includes a combination of these assets to balance risk and potential returns.

If you have experience or interest in the real estate market, investing in real estate can be an attractive option. Real estate investments can take various forms:

Rental Properties: Purchasing residential or commercial properties and renting them out can provide steady rental income and potential appreciation in property value. However, being a landlord requires active involvement in property management and dealing with tenant-related responsibilities.

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate properties. By investing in REITs, you can gain exposure to real estate without the need to directly own and manage properties. REITs typically pay out a significant portion of their income as dividends to shareholders.

Real Estate Crowdfunding: Real estate crowdfunding platforms allow you to invest in real estate projects alongside other investors. These platforms pool funds from multiple investors to finance property acquisitions or development projects. Real estate crowdfunding offers accessibility to real estate investments with lower investment minimums compared to traditional real estate purchases.

When investing in real estate, it’s important to consider factors such as location, property type, market conditions, and the potential for rental income or property appreciation. Conducting thorough research and due diligence is crucial to mitigate risks and maximize returns.

Mutual funds and ETFs offer convenient ways to achieve diversification across multiple securities and asset classes. They are managed by professional portfolio managers and can be an excellent choice for investors seeking instant diversification without having to research and select individual investments.

Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of securities, such as stocks, bonds, or a combination of both. They are managed by professional fund managers who make investment decisions on behalf of the investors. Mutual funds can be actively managed, where the fund manager actively selects investments, or passively managed, where the fund aims to replicate the performance of a specific market index.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs can offer instant diversification, transparency, and lower expense ratios compared to some mutual funds. They can track specific market indices, sectors, or asset classes.

When considering mutual funds or ETFs, factors such as expense ratios, historical performance, fund objectives, and the fund manager’s track record should be evaluated. It’s essential to align your investment goals and risk tolerance with the fund’s investment strategy.

Index funds are a type of mutual fund or ETF that aims to replicate the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. Index funds offer a passive investment approach that seeks to match the returns of the chosen index rather than outperform it.

The advantages of index funds include:

Investing in index funds can be an effective strategy, especially for passive investors who want to capture the overall market’s returns and minimize fees.

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate properties. REITs allow individual investors to invest in a professionally managed portfolio of real estate assets without having to directly own and manage properties.

Key benefits of investing in REITs include:

When considering REITs, it’s important to evaluate factors such as the REIT’s track record, property portfolio, dividend history, and management team’s expertise.

Investing in commodities involves buying and selling physical goods, such as precious metals, oil, agricultural products, or industrial metals. Commodities can provide diversification benefits and act as a hedge against inflation.

Here are some common ways to invest in commodities:

Investing in commodities can add diversification to your portfolio, but it’s important to understand the risks associated with commodity price volatility and the specific dynamics of the commodities market.

Before allocating your home sale proceeds to specific investments, it’s essential to set clear investment objectives. Your investment objectives should align with your financial goals, risk tolerance, and time horizon. Are you primarily seeking capital appreciation, income generation, or a combination of both? Clarifying your investment objectives will help guide your decision-making process and ensure your portfolio is aligned with your desired outcomes.

Once you have established your investment objectives, it’s time to determine the appropriate allocation of your funds across different asset classes. Asset allocation refers to the distribution of your investment capital among stocks, bonds, real estate, and other asset classes.

The optimal asset allocation depends on several factors, including your risk tolerance, time horizon, and market conditions. Generally, a diversified portfolio includes a mix of assets that balances risk and potential returns. Younger investors with a longer time horizon may have a higher allocation to growth-oriented assets such as stocks, while those closer to retirement may prefer a more conservative allocation with a larger proportion of fixed-income investments.

Your investment horizon refers to the length of time you expect to hold your investments before needing to access the funds. It’s an important factor to consider when selecting investments and determining your risk tolerance.

For short-term investment horizons, such as funds needed within a year or two, it’s generally recommended to focus on more conservative and liquid investments, such as cash equivalents or short-term bonds. Longer investment horizons allow for a more aggressive investment approach, as there is more time to recover from market downturns and potentially benefit from long-term growth opportunities.

By aligning your investment horizon with your investment strategy, you can select investments that match your time frame and optimize your risk-reward profile.

Navigating the world of investments can be complex, especially when dealing with a significant sum of money from a home sale. Seeking professional advice from a financial advisor can provide valuable guidance and expertise.

Financial advisors can help you:

When selecting a financial advisor, consider factors such as qualifications, experience, fiduciary responsibilities, and fee structure. Choose an advisor who understands your unique needs and has a track record of delivering value to their clients.

When selecting a financial advisor, it’s important to consider your specific needs and preferences. Here are some factors to keep in mind:

By choosing the right financial advisor, you can benefit from their expertise and ensure that your investment decisions align with your financial objectives.

Investing always carries some degree of risk, and it’s important to manage and mitigate risks to protect your portfolio. Here are some risk management techniques to consider:

By implementing these risk management techniques, you can mitigate potential losses and safeguard your investment portfolio.

Investing is an ongoing process that requires regular assessment and adjustment. As your financial goals change, market conditions fluctuate, or new investment opportunities arise, it’s important to review and adjust your portfolio accordingly.

Regular portfolio assessment involves:

Regularly reassessing and adjusting your portfolio ensures that your investments remain aligned with your financial goals and changing market conditions.

When investing the proceeds from your home sale, it’s important to consider the tax implications of your investment decisions. While taxes should not drive your investment strategy, optimizing your investments for tax efficiency can help maximize your after-tax returns.

Here are some key tax considerations:

Consulting with a tax professional can provide valuable guidance on optimizing your investments from a tax perspective and ensuring compliance with applicable tax laws.

To optimize your investments for tax efficiency, consider the following strategies:

Implementing these tax-efficient investing strategies can help reduce your tax burden and potentially enhance your after-tax returns.

Reinvesting dividends and returns is a powerful wealth-building strategy that harnesses the compounding effect. Compounding allows your investment returns to generate additional returns over time.

When you reinvest dividends or other investment returns:

Reinvesting dividends and returns can accelerate the growth of your investment portfolio and help you achieve your financial goals faster.

Here are some strategies to consider when reinvesting your investment income:

By reinvesting your investment income, you harness the power of compounding and make your money work harder for you over time.

If you haven’t already done so, consider utilizing Individual Retirement Accounts (IRAs) and 401(k)s to maximize the tax advantages and long-term growth potential of your investments.

Traditional IRAs and 401(k)s: Contributions to traditional IRAs and 401(k)s are made with pre-tax dollars, reducing your current taxable income. The contributions grow tax-deferred, meaning you don’t pay taxes on the investment gains until you withdraw the funds during retirement.

Roth IRAs and Roth 401(k)s: Roth accounts are funded with after-tax dollars, meaning contributions are made with money that has already been taxed. However, qualified withdrawals from Roth accounts, including investment gains, are tax-free during retirement.

Contributing to IRAs and 401(k)s allows you to take advantage of tax benefits while saving for retirement. Consider maximizing your contributions to these accounts, especially if you have additional funds from your home sale proceeds that you want to allocate toward long-term retirement savings.

To maximize the tax advantages of retirement accounts:

By strategically utilizing retirement accounts and maximizing their tax advantages, you can enhance your long-term savings and create a more tax-efficient retirement income stream.

When building your investment portfolio, you can choose between passive and active investment approaches. Understanding the pros and cons of each can help you make informed decisions.

Passive Investments: Passive investments seek to replicate the performance of a specific market index or asset class. Passive investors aim to capture broad market returns rather than outperform the market. Passive strategies often involve investing in index funds or ETFs.

Pros of Passive Investments:

Cons of Passive Investments:

Active Investments: Active investments involve making individual security selections and actively managing the portfolio. Active investors aim to outperform the market by identifying mispriced assets or taking advantage of market inefficiencies.

Pros of Active Investments:

Cons of Active Investments:

Many investors find value in blending passive and active investment strategies to achieve optimal results. By combining both approaches, you can benefit from the broad market exposure and cost efficiency of passive investments while leveraging the potential for outperformance and customization offered by active investments.

Consider the following strategies for blending passive and active investments:

By blending passive and active strategies, you can create a well-rounded portfolio that balances market exposure, cost efficiency, and the potential for outperformance.

Investing in rental properties can provide a steady stream of income and potential appreciation in property value. Here are some strategies to consider when building a real estate investment portfolio:

Investing in rental properties requires careful research, due diligence, and ongoing management. Consider working with experienced professionals, such as real estate agents or property managers, to navigate the real estate investment landscape successfully.

House flipping involves purchasing a property, renovating it, and selling it for a profit in a relatively short period. This strategy can generate substantial returns but comes with higher risks and requires specific expertise. Here are some considerations for house flipping:

House flipping can be financially rewarding but carries higher risks compared to long-term rental property investments. Extensive research, market knowledge, and hands-on management are crucial for successful house-flipping ventures.

As you build your investment portfolio, it’s important to consider long-term wealth preservation and protection. Estate planning and asset protection strategies can help ensure that your wealth is safeguarded and passed on to future generations according to your wishes.

Here are some key considerations for estate planning and asset protection:

Consulting with an experienced estate planning attorney and financial advisor can help you develop a comprehensive plan that addresses your specific goals and protects your wealth for future generations.

Building your investment portfolio with your home sale proceeds can be a significant step toward achieving your financial goals. By diversifying your investments across different asset classes, such as stocks, bonds, real estate, and other investment vehicles, you can reduce risk and increase the potential for long-term returns.

Consider your investment objectives, risk tolerance, and time horizon when allocating your funds. Seek the guidance of a qualified financial advisor to develop a customized investment strategy that aligns with your unique needs.

Take advantage of tax-efficient investing strategies, maximize contributions to retirement accounts, and consider blending passive and active investment approaches to optimize your returns.

Furthermore, if you choose to invest in real estate, thoroughly research the market, evaluate potential rental properties or house flipping opportunities, and carefully manage risks.

Lastly, don’t forget to incorporate estate planning and asset protection into your overall financial strategy. Establishing a comprehensive estate plan and implementing asset protection strategies can help safeguard your wealth for the long term.

Remember, building an investment portfolio requires careful consideration, ongoing monitoring, and adjustments as needed. Stay informed, regularly assess your portfolio’s performance, and make informed decisions to ensure your investments align with your evolving financial goals.

The amount you allocate toward investments depends on several factors, including your financial goals, risk tolerance, and current financial situation. It’s important to strike a balance between investing for the future and managing your obligations responsibly. Consider consulting with a financial advisor who can provide personalized recommendations based on your circumstances.

There is no one-size-fits-all answer to this question as the optimal asset allocation depends on your individual circumstances and investment goals. Factors such as your risk tolerance, time horizon, and market conditions should be taken into account. A diversified portfolio that includes a mix of stocks, bonds, real estate, and other investments is generally recommended. However, the specific allocation will vary based on your preferences and financial situation.

Investing in individual stocks requires careful research and analysis, as it involves selecting specific companies. This approach requires more time and expertise compared to investing in mutual funds or ETFs, which provide instant diversification. Mutual funds and ETFs are managed by professionals and offer exposure to a broader range of securities. Consider your investment knowledge, time commitment, and risk tolerance when deciding between individual stocks and funds/ETFs.

There are several tax-efficient investing strategies to consider, such as maximizing contributions to tax-advantaged retirement accounts like IRAs and 401(k)s, tax-loss harvesting to offset capital gains, and strategic asset location to optimize tax treatment. Consulting with a tax professional can help you identify the most appropriate strategies based on your specific situation.

While it’s not mandatory to work with a financial advisor, their expertise can provide valuable guidance and help ensure that your investment decisions align with your financial goals. A financial advisor can assess your financial situation, develop a customized investment strategy, provide ongoing portfolio management, and offer comprehensive financial planning services. Consider your own knowledge and comfort level with investing before deciding whether to work with a financial advisor.

If you want the Richr team to help you save thousands on your home just book a call.