Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

A closing is the ‘finish line’ in the long process of finalizing a real estate transaction. This is when all the legal documents for the transaction and any loan documents are signed, funds are transferred, and the buyer gets the keys to their new home. The proceedings are controlled by closing agents, who can be members of title-closing companies or attorneys. They are independent and impartial third parties to the transaction who manage the closing process.

Numerous parties can be involved in the closing including a lender, loan officer, title insurance company, escrow company, closing agent, attorneys for each side and the buyer and seller themselves.

Closing companies and attorneys are both qualified to act as a closing agent and provide title services by completing the same course. However closing attorneys like Mila Lopata are able to combine title insurance, escrow and attorney services. She says it makes sense to use an attorney who is qualified as a closing agent over a title-closing company.

Mila told us “Whereas a title company needs to carry a bond of $50,000 to open their business, an attorney has their license at risk if anything goes wrong so they have more to lose if they fail in their professional duties.”

Using an attorney also has the benefit of you being able to hire them to advise on the terms of the transaction, and they can assist if the closing goes awry, for example if one party defaults. Depending on the value of the home, the cost of a closing agent will vary from around $750 to $850. In Miami-Dade and Broward this fee is customarily paid by the Buyer. Elsewhere in Florida, the Seller would normally pay. As a general rule of thumb, the party that pays is that party that chooses the closing agent.

Closing attorneys verify that all legal documents relating to the transaction are correct, that title to the property is legitimate, they issue title insurance policies and they manage the closing process. They ensure the necessary documents are filed at the county records office to register your interest in the property. You can’t buy a house without a closing agent.

Every buyer must have title insurance to protect them and any mortgage lender against defects and disputes concerning the title, providing damages to rectify such deficiency. Even if your lender has their title insurance policy, a buyer will need their own, and it’s much more cost effective to obtain policies for the buyer and lender at the same time. Every closing agent works with a specific title insurance company. It is still sensible to check the company is well-known and has a good track record. Ideally, they will be in business over the term of your home ownership so that they can pay-out should an issue relating to title arise. The title insurance fee is specified by Florida statute. It is based on the sales price of the home and is uniform throughout all title insurance companies.

Title searches are a necessary part of verifying that the home sale is legitimate. They will reveal and verify (i) the legal owner/s of the property, (ii) whether there is a mortgage, liens, unpaid taxes or other debts affecting the title to the home and (iii) if there are any leases or other restrictions affecting the property. All of these will need to be cleared prior to the closing.

Certain states require an attorney to be present at a closing; Florida does not require attorneys to be present. However, a seller’s attorney can be useful in preparing sellers documents such as disclosures, the warranty deed, Bill Of Sale, closing affidavit and possibly more, depending on the circumstance. It would certainly be advisable to hire an attorney if you had concerns about the terms of the transaction, or if the transaction involved a short-sale or foreclosure as you will want to protect your financial position.

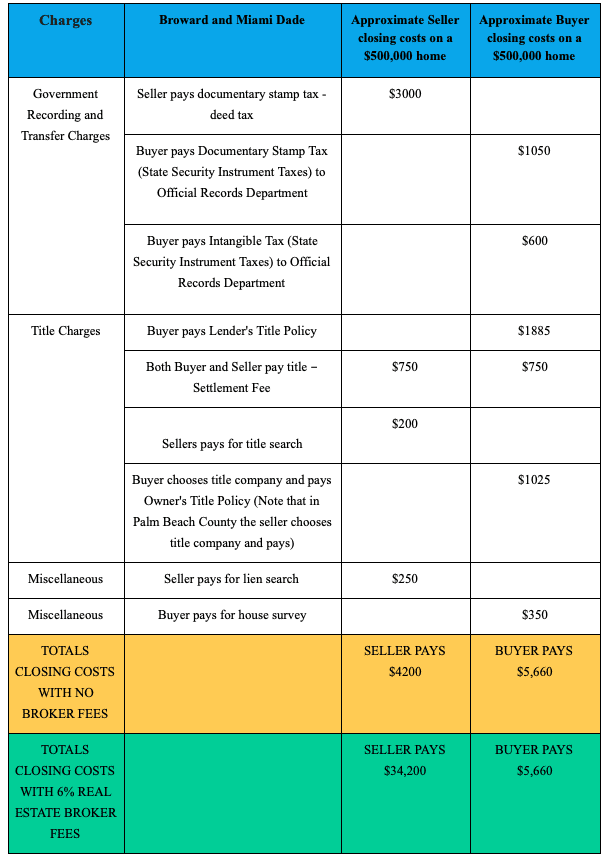

A Settlement statement will set out the closing costs associated with the sale. Below is a guide to closing costs on a $500,000 home and an indication of which party is responsible.

Mila Lopata is a Closing Attorney with over ten years experience. She can be contacted at 400 Sunny Isles Blvd CU-1, Sunny Isles Beach, FL 33160-5080, on 786-999-6494 or by email at mila@milalaw.com

If you’re looking to buy or sell a house and would like to discuss your option, Richr can help you!

Our fully licensed Concierge Team is here to answer questions and provide free, objective advice on how to get the best outcome with your sale or purchase.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call