Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

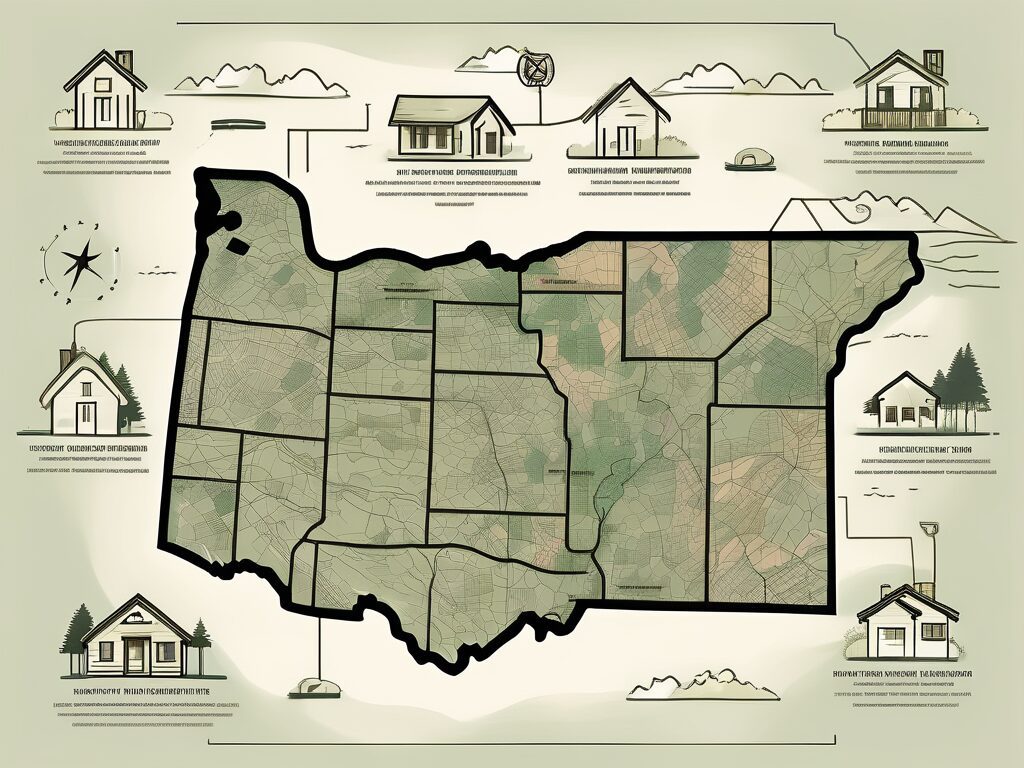

One of the most important aspects of securing a loan for a home in Oregon is understanding the FHA loan limits. FHA loans are a popular choice for many homebuyers because they offer competitive interest rates and flexible qualifying criteria. However, it is crucial to be aware of the loan limits set by the Federal Housing Administration (FHA) to ensure that you are eligible for this type of financing. In this article, we will delve into FHA loan limits in Oregon and provide you with all the information you need to know.

When it comes to FHA loans, each state has specific loan limits that borrowers must adhere to. These loan limits are determined by factors such as the median home prices in various counties within the state. By understanding how loan limits are determined, you can assess your homebuying options and plan your budget accordingly.

In Oregon, FHA loan limits vary by county. Each county has its own maximum loan amount that borrowers can qualify for. These loan limits take into account the median home prices in each county, ensuring that the FHA loans are accessible to a wide range of borrowers across the state.

For instance, in Multnomah County, which encompasses Portland, the FHA loan limit for a single-family home is set at $379,500. This means that borrowers looking to purchase a home in this county can secure an FHA loan up to this amount without needing a higher-cost loan.

Conversely, in smaller counties with lower median home prices, the FHA loan limits may be lower. However, even in these counties, the loan limits are set at a level that allows borrowers to finance homes within the local market.

Let’s take a closer look at some of the counties in Oregon and their respective FHA loan limits:

As mentioned earlier, Multnomah County has an FHA loan limit of $379,500 for a single-family home. This is the highest loan limit in the state, reflecting the higher home prices in the Portland area. With this loan limit, borrowers have the opportunity to purchase a variety of homes within the county, from cozy bungalows to spacious family houses.

Washington County, which is adjacent to Multnomah County, also has a relatively high FHA loan limit. For a single-family home, the loan limit is set at $379,500. This allows borrowers in this county to take advantage of the FHA loan program and secure financing for their dream homes.

Clackamas County, located southeast of Portland, has an FHA loan limit of $379,500 for a single-family home. With this loan limit, borrowers in Clackamas County can explore various housing options, including suburban neighborhoods and rural properties.

Marion County, home to the state capital of Salem, has an FHA loan limit of $331,760 for a single-family home. While this limit is slightly lower compared to the counties mentioned earlier, it still provides borrowers with ample opportunities to purchase homes within the county.

These are just a few examples of the FHA loan limits in Oregon. It’s important to note that these limits are subject to change annually, based on the fluctuations in median home prices. Therefore, it’s crucial for potential homebuyers to stay updated on the current loan limits in their desired counties.

By understanding the FHA loan limits in Oregon, borrowers can make informed decisions about their homebuying journey. Whether you’re looking to settle down in a bustling city or prefer the tranquility of a rural area, the FHA loan program offers flexibility and accessibility to help you achieve your homeownership goals.

The FHA loan limits in Oregon are primarily influenced by the median home prices in each county. This ensures that the loan limits reflect the local housing market’s affordability and accessibility. If the median home prices in a county increase, the FHA loan limits for that particular county may also rise to accommodate the changing market conditions and maintain accessibility.

In addition to median home prices, there are several other factors that contribute to the determination of FHA loan limits. One such factor is the overall economic health of the county. If a county has a strong economy with low unemployment rates and high job growth, it may result in higher FHA loan limits as it indicates a stable housing market.

Another factor that is taken into consideration is the demand for housing in a particular county. If there is a high demand for housing, it may lead to an increase in FHA loan limits to ensure that potential homebuyers have access to affordable financing options.

The median home prices play a vital role in determining the FHA loan limits. The FHA considers the median home prices data to ascertain the loan limits for different counties. This data is sourced from local real estate market reports and analyzed to set appropriate loan limits.

Furthermore, the FHA takes into account the housing market trends and forecasts for each county. By analyzing these trends, they can make informed decisions about adjusting loan limits to align with the changing market conditions.

It’s important to note that FHA loan limits are updated annually. Therefore, it’s crucial to stay informed about any changes in loan limits in the county where you plan to purchase a home. Keeping track of these changes can help potential homebuyers make informed decisions about their financing options and ensure they are aware of the maximum loan amount they can qualify for.

Moreover, the FHA loan limits are not set in stone and can be adjusted based on various factors such as changes in the housing market, economic conditions, and government policies. These adjustments are made to ensure that the loan limits remain relevant and in line with the current market conditions.

In conclusion, the determination of FHA loan limits involves a comprehensive analysis of various factors, including median home prices, economic health, housing demand, and market trends. By considering these factors, the FHA aims to establish loan limits that promote accessibility and affordability in the housing market, allowing more individuals and families to achieve their dream of homeownership.

Once you understand the FHA loan limits in Oregon, you can start navigating the qualification process for an FHA loan. The FHA provides more flexible qualifying criteria compared to conventional loans, making it accessible to a wider pool of borrowers.

When it comes to qualifying for an FHA loan in Oregon, there are several key requirements that you need to meet. The first requirement is having a steady income. Lenders want to ensure that you have a reliable source of income to make your monthly mortgage payments. This can be demonstrated through pay stubs, tax returns, and other financial documents.

Another important requirement is having a credit score of at least 580. A higher credit score shows lenders that you have a history of responsible financial behavior and are more likely to repay your loan. However, if your credit score falls between 500 and 579, don’t worry! You may still be eligible for an FHA loan, but you will need to make a higher down payment of 10% instead of the standard 3.5%.

In addition to the income and credit score requirements, you will also need to come up with a down payment. For an FHA loan, the down payment is typically 3.5% of the purchase price. This means that if you’re buying a home for $200,000, your down payment would be $7,000. Having a down payment shows lenders that you have some skin in the game and are committed to the property.

It’s important to note that as an FHA borrower, you will also be required to pay mortgage insurance premiums (MIP). This is an additional cost that helps protect lenders in case borrowers default on their payments. The MIP is typically paid monthly and is based on the loan amount and the loan-to-value ratio.

One of the significant advantages of FHA loans in Oregon is the opportunity to purchase a multifamily property. With an FHA loan, you can finance a property with up to four units, allowing you to live in one unit and rent out the others. This can be a smart financial move, as the rental income can help cover your mortgage payments and potentially generate additional income.

When considering buying a multifamily property with an FHA loan, it’s essential to carefully analyze the rental market in your area. You’ll want to ensure that there is demand for rental units and that the rental income will be sufficient to cover your expenses. Conducting thorough market research and consulting with a real estate professional can help you make an informed decision.

Another benefit of buying a multifamily property with an FHA loan is the potential for long-term wealth building. By owning a multifamily property, you have the opportunity to build equity over time as the property appreciates in value. Additionally, if you decide to sell the property in the future, you may be able to generate a significant return on your investment.

It’s important to note that managing a multifamily property requires time, effort, and potentially additional expenses. As a landlord, you’ll be responsible for finding and screening tenants, handling maintenance and repairs, and complying with local rental regulations. However, if you’re willing to put in the work, owning a multifamily property can be a rewarding and profitable venture.

Now that you have a better understanding of FHA loan limits in Oregon and the qualification process, it’s time to find reputable FHA lenders. Working with experienced lenders who specialize in FHA loans can make the process smoother and more efficient.

When it comes to finding FHA lenders in Oregon, you want to ensure that you are working with professionals who have a strong track record in FHA loans. These lenders should have a comprehensive understanding of the local market and be able to provide you with the guidance you need to navigate the FHA loan process.

One of the top FHA lenders in Oregon is XYZ Mortgage. With years of experience in the industry, XYZ Mortgage has helped numerous homebuyers secure FHA financing for their dream homes. Their team of experts is well-versed in the intricacies of FHA loans and can answer any questions you may have.

Another reputable FHA lender in Oregon is ABC Bank. Known for their excellent customer service and commitment to helping homebuyers achieve their homeownership goals, ABC Bank has a strong reputation in the community. They understand the unique challenges and opportunities in the Oregon housing market and can provide you with tailored solutions.

If you’re looking for a lender that offers a wide range of FHA loan options, DEF Home Loans is a great choice. They have a diverse portfolio of loan products and can help you find the financing that best suits your needs. Whether you’re a first-time homebuyer or looking to refinance, DEF Home Loans has the expertise to guide you through the process.

When researching FHA lenders in Oregon, it’s important to consider customer reviews as well. Reading about other homebuyers’ experiences can give you valuable insights into a lender’s reputation and customer service. Look for lenders with positive reviews and testimonials from satisfied customers.

In conclusion, understanding FHA loan limits in Oregon is essential for homebuyers looking to finance their purchase through an FHA loan. By familiarizing yourself with the loan limits set by the FHA and the qualification process, you can make informed decisions and increase your chances of securing the home loan that meets your needs.

Remember to keep yourself updated with any changes in loan limits and work with reputable FHA lenders to ensure a smooth and successful homebuying experience. With the help of experienced lenders like XYZ Mortgage, ABC Bank, and DEF Home Loans, you can confidently navigate the FHA loan process and find the financing you need to purchase your dream home in Oregon.

As you consider your FHA loan options in Oregon, don’t forget the importance of understanding your property’s value. Richr is here to support your journey with a complimentary home valuation that can aid in your decision-making process. Whether you’re selling FSBO or simply seeking insights into your property’s worth, Richr’s platform connects you to consumer portals and MLS listings for maximum exposure. Ready to unlock your free CMA? Call Richr on 844-957-4247 today and take the first step towards a successful real estate transaction.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call