Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

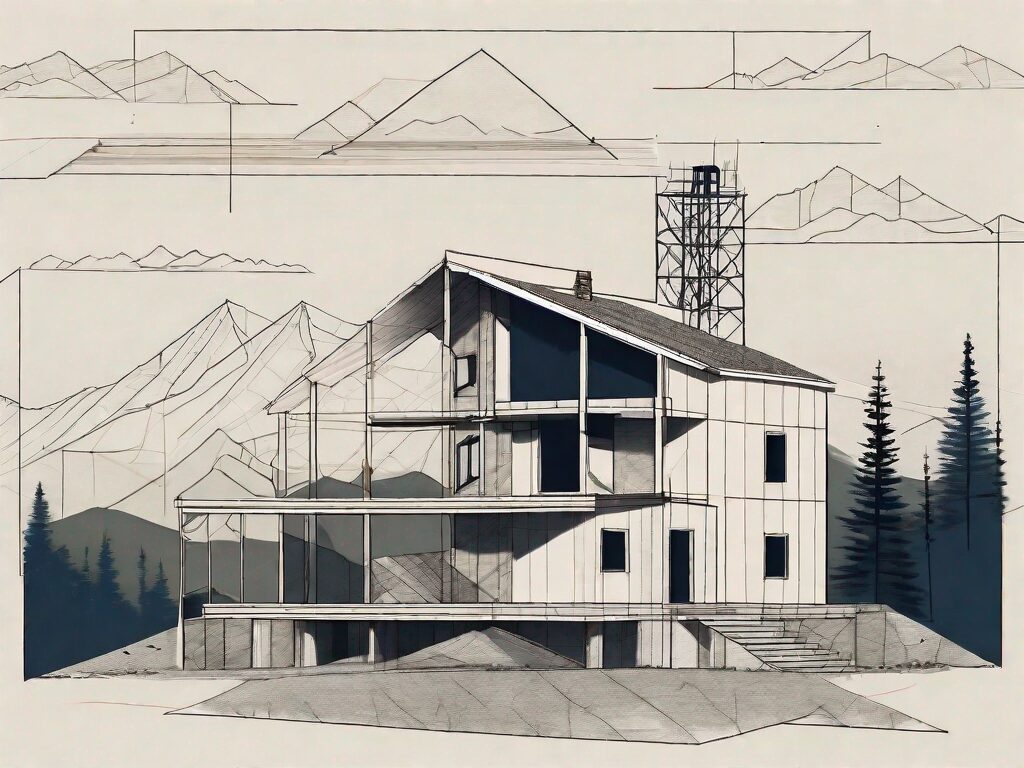

Building your own house can be an exciting prospect, as it allows you to create the perfect home tailored to your needs and preferences. However, it also comes with its own set of challenges and considerations, particularly when it comes to finances. If you’re considering building a house in Virginia (VA) in 2024, this comprehensive guide will provide you with valuable insights into the cost aspects involved.

Building your own house in Virginia offers a range of advantages and disadvantages that you should carefully consider before embarking on this journey.

Virginia, known for its rich history and stunning landscapes, provides an ideal backdrop for those looking to build their dream home. From the charming streets of Alexandria to the rolling hills of Charlottesville, this state offers a diverse range of locations to choose from.

Building your own house in Virginia can provide several benefits. Firstly, you have the opportunity to customize every aspect of your home, from the layout to the finishes, ensuring it perfectly suits your needs and tastes. Imagine having a spacious kitchen with granite countertops, a cozy fireplace in the living room, and a luxurious master suite with a spa-like bathroom.

Additionally, building a new home allows you to take advantage of the latest construction techniques and energy-efficient technologies, potentially reducing ongoing maintenance and utility costs. With the rising concern for environmental sustainability, building a green home in Virginia can not only save you money but also contribute to a healthier planet.

However, it’s important to consider the potential downsides of building your own house in Virginia. It requires significantly more time and effort compared to buying an existing property. From acquiring permits and finding the right contractors to overseeing the construction process, building a home demands dedication and patience.

Furthermore, unforeseen delays and cost overruns can occur during the construction process, which can increase both financial and emotional stress. It’s crucial to have a contingency plan and a solid budget in place to mitigate these risks.

When considering the cost aspect, it is essential to compare building a house in Virginia to buying an existing one. While buying a house may seem initially cheaper, building offers advantages in terms of long-term financial benefits.

Building a house allows you to construct a home that meets your specific requirements, avoiding the expenses associated with renovations or remodeling. You can choose energy-efficient appliances and install solar panels, reducing your carbon footprint and potentially qualifying for tax incentives.

Furthermore, new homes tend to have lower maintenance costs and energy bills, leading to potential long-term savings. With the advancements in construction materials and techniques, you can build a house that is not only aesthetically pleasing but also built to last.

However, it’s important to note that building a house in Virginia requires careful financial planning. From purchasing the land to hiring architects and contractors, the costs can add up quickly. It’s crucial to obtain multiple quotes and thoroughly research the market to ensure you are getting the best value for your investment.

In conclusion, building your own house in Virginia can be an exciting and rewarding experience. From the freedom to customize every detail to the potential long-term financial benefits, it offers a unique opportunity to create a home that reflects your vision and lifestyle. However, it’s important to approach the process with careful consideration and thorough planning to ensure a successful outcome.

Before diving into the process of building your dream home in Virginia, it is crucial to gain a comprehensive understanding of the costs involved. Building a house is a significant financial undertaking, and being well-informed about the expenses can help you plan and budget effectively.

When it comes to the average cost of building a house in Virginia, there are several factors to consider. These factors include the size of the house, its location, the materials used, and the finishes chosen. Each of these elements can have a significant impact on the overall cost.

According to recent data, the average cost per square foot to build a house in Virginia ranges between $100 and $200. However, it is important to note that this figure is just a starting point and does not take into account certain additional costs.

One such cost is land acquisition. The price of the land itself can vary greatly depending on the location and size of the plot. Additionally, site preparation is another expense to consider. This includes tasks such as clearing the land, grading, and preparing the foundation.

Utility connections are yet another factor that can add to the cost of building a house. These connections include water, electricity, gas, and sewage systems. The cost of hooking up to these utilities can vary depending on the distance from the property to the nearest connection points.

Considering these additional costs, it is advisable to factor in a contingency budget of around 10-15% to account for unexpected expenses that may arise during the construction process. This buffer can help ensure that you are financially prepared for any unforeseen circumstances.

Several factors can influence the cost of building a house in Virginia. One such factor is the design complexity. A more intricate and unique design will often require additional materials and labor, which can drive up the overall cost.

The quality of finishes is another factor to consider. Choosing high-end finishes such as hardwood flooring, custom cabinetry, and premium appliances can significantly increase the cost of construction.

Site conditions can also impact the expenses. If the land has challenging terrain or requires extensive site work, such as excavation or retaining walls, these additional tasks can add to the overall cost.

Lastly, the current state of the construction market can affect the cost of building a house in Virginia. During periods of high demand and limited supply, construction costs tend to rise. It is important to consider the market conditions when planning your project.

Ultimately, understanding the costs associated with building a house in Virginia is essential for a successful and well-managed construction project. By considering all the factors and potential expenses, you can make informed decisions and ensure that your dream home becomes a reality within your budget.

Turning your dream of building a house in Virginia into a reality requires careful financial planning and adequate financing options. Building a home is an exciting venture, but it can also be a complex process. One of the most critical aspects of building your dream home is finding the right financing solution that suits your needs and budget.

A common method to finance your new home construction in Virginia is through a home construction loan. These loans provide funds in stages, enabling you to pay for the construction process as it progresses. With a home construction loan, you can secure the necessary funds to cover the cost of land, materials, labor, and other expenses associated with building your dream home.

When considering a home construction loan, it is crucial to research different lenders to find competitive interest rates, favorable terms, and flexible repayment options. You want to ensure that the loan terms align with your financial goals and capabilities. Additionally, understanding the loan process, including the application, approval, and disbursement stages, is essential to ensure a smooth financing experience.

It is also worth noting that home construction loans typically require a down payment, which can range from 20% to 25% of the total project cost. This down payment demonstrates your commitment to the project and reduces the lender’s risk.

If you do not qualify for a traditional construction loan or prefer a more streamlined application process, personal loans can be an alternative. Personal loans are unsecured loans that can be used for various purposes, including building a house. However, keep in mind that personal loans generally have higher interest rates and shorter repayment terms compared to home construction loans.

When considering a personal loan for building a house in Virginia, it is essential to evaluate your financial situation carefully. Determine if the higher interest rates and shorter repayment terms align with your budget and long-term financial goals. Additionally, compare different lenders to find the most favorable terms and conditions.

Personal loans can provide the flexibility and convenience you need to finance your dream home construction, but it is crucial to weigh the pros and cons and make an informed decision.

If you already own a property and have accumulated equity, a home equity loan can be an option to finance your new house construction in Virginia. This type of loan uses the equity in your existing home as collateral, allowing you to borrow against the appraised value of your property.

Home equity loans typically offer lower interest rates compared to personal loans since they are secured by your property. This can result in more affordable monthly payments and potentially save you money in the long run. However, it is crucial to consider the risks associated with using your home as collateral, as defaulting on the loan could lead to foreclosure.

Before opting for a home equity loan, it is essential to assess your financial situation and determine if borrowing against your home’s equity is the right choice for you. Consider factors such as your current mortgage balance, the value of your property, and your ability to repay the loan.

Additionally, consult with a financial advisor or mortgage specialist to ensure that you fully understand the terms and conditions of a home equity loan and its potential impact on your overall financial well-being.

Financing your dream home in Virginia requires careful consideration of various loan options. Whether you choose a home construction loan, a personal loan, or a home equity loan, it is crucial to evaluate your financial situation, research different lenders, and make an informed decision that aligns with your long-term goals. With the right financing solution, you can turn your dream of building a house in Virginia into a reality.

Deciding whether to build a house in Virginia requires careful consideration of several factors, including your budget, preferences, and future plans.

Virginia, known for its rich history and natural beauty, offers a diverse range of landscapes and communities to choose from. From the bustling cities of Richmond and Arlington to the serene countryside of Charlottesville and Roanoke, the state has something to offer for everyone.

When it comes to building a house in Virginia, one of the first things to consider is the cost. The cost of building a house can vary greatly depending on various factors, such as the size of the house, the location, and the materials used.

If you’re considering building a house with a specific size, such as a 2,500 sq ft house in Virginia, it is essential to calculate the estimated cost. Using the average cost per square foot mentioned earlier, the total cost can range from $250,000 to $500,000 or more, depending on the factors mentioned earlier.

However, it’s important to note that the cost of building a house is not just limited to the construction itself. Other expenses, such as permits, design fees, and landscaping, should also be taken into account.

Understanding the average cost per square foot in Virginia can give you a rough estimate of the overall expenses. Keep in mind that this figure can vary significantly based on the factors specific to your desired home.

Factors such as the complexity of the design, the quality of materials used, and the location of the property can all influence the cost per square foot. For example, building a house in a high-end neighborhood or using premium materials will likely increase the cost per square foot.

Foundations are a crucial component of any house construction. Depending on the soil condition and the complexity of the foundation design, the cost can range from $10,000 to $30,000 or more. It is advisable to consult with a professional engineer or contractor to get an accurate estimate.

In Virginia, the soil composition can vary significantly from one region to another. Some areas have stable soil conditions, while others may require additional measures, such as soil stabilization or deep foundation systems, to ensure the stability and longevity of the house.

Additionally, the cost of foundations can also be influenced by the size and design of the house. Larger houses or those with intricate architectural features may require more extensive foundation work, thus increasing the overall cost.

Before making a decision to build in Virginia, it’s important to thoroughly research and consider all the factors involved. From the cost of construction to the unique characteristics of the region, taking the time to gather information will help you make an informed decision that aligns with your goals and aspirations.

In addition to the above considerations, you might have additional questions and concerns. Here are answers to some common questions regarding building a house in Virginia:

While it is possible to act as your own general contractor and oversee the construction process, it requires extensive knowledge and experience in the building industry. It may be more practical for most homeowners to hire a licensed general contractor to ensure the project’s smooth execution.

Building a house is a complex undertaking that involves various trades and specialized skills. From foundation work to framing, electrical, plumbing, and finishing, each aspect of the construction process requires expertise. While some homeowners may have the necessary skills to handle certain tasks, it is crucial to consider the time, effort, and potential risks involved in taking on the role of a general contractor.

By hiring a licensed general contractor, you can benefit from their experience, network of reliable subcontractors, and knowledge of local building codes and regulations. They can navigate the complexities of the construction process, coordinate different trades, and ensure that the project is completed efficiently and up to code.

Building a house in Virginia requires obtaining several permits and undergoing inspections to ensure compliance with local building codes and regulations. These include building permits, electrical permits, plumbing permits, and inspections at different stages of the construction process.

Obtaining the necessary permits is a crucial step in the construction process. Building permits are typically required for new construction, additions, and major renovations. These permits ensure that the construction plans meet the minimum safety standards set by the local authorities.

In addition to building permits, electrical and plumbing permits are necessary for any electrical or plumbing work involved in the construction process. These permits ensure that the electrical and plumbing systems are installed correctly and meet the required standards.

Inspections are conducted by local building inspectors at various stages of the construction process. These inspections ensure that the work is being done according to the approved plans and in compliance with the building codes. Inspections may be required for the foundation, framing, electrical, plumbing, insulation, and final occupancy.

The duration of the construction process can vary depending on the size and complexity of the house, weather conditions, and other factors. On average, it can take anywhere from six to twelve months or longer to complete a custom-built house in Virginia.

Several factors can impact the timeline of a house construction project. The size and complexity of the house play a significant role in determining the construction duration. Larger and more intricate designs may require additional time for planning, engineering, and construction.

Weather conditions can also affect the construction timeline. Extreme weather events, such as heavy rain or snow, can cause delays in the construction process. It is essential to factor in potential weather-related delays when estimating the timeline for building a house in Virginia.

Other factors that can influence the construction duration include the availability of labor and materials, the efficiency of the construction crew, and any unforeseen issues or changes that may arise during the construction process.

While hiring an architect is not a legal requirement in Virginia, it is highly recommended to engage a professional architect or designer to create detailed plans and ensure the functional and aesthetic aspects of your new home.

An architect plays a crucial role in the house construction process. They have the expertise to design a home that meets your specific needs and preferences while considering factors such as site conditions, building codes, and sustainability. Architects can create detailed drawings and specifications that guide the construction process and help contractors understand your vision.

In addition to the functional aspects, architects also focus on the aesthetic appeal of the house. They can help you achieve a cohesive and visually pleasing design that reflects your personal style. From selecting materials to creating unique architectural features, architects bring a creative and artistic touch to the project.

Collaborating with an architect can also streamline the construction process by ensuring that the plans are accurate and comprehensive. This can help prevent costly errors and changes during construction, saving both time and money.

While hiring an architect adds an additional cost to the project, their expertise and guidance can result in a well-designed and thoughtfully executed home that meets your expectations.

Building a house in Virginia can be a rewarding endeavor if approached with thorough planning and careful consideration of the cost aspects. By understanding the average costs, financing options, and the pros and cons, you can make an informed decision and turn your dream home into a reality.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call