The Impact of Local Events on Home Sales

In the world of real estate, numerous factors contribute to…

June 30, 2023

34% of U.S. residents are living mortgage free. For 66% of homeowners (the majority of us) the first thing that happens when we sell our home is our mortgage company deducts the balance on our mortgage from the sale price. Of the remainder, real estate agent fees are deducted.

We discovered a secret that no-one in the real estate industry addresses, which is the real cost of 6% agent fees to sellers.

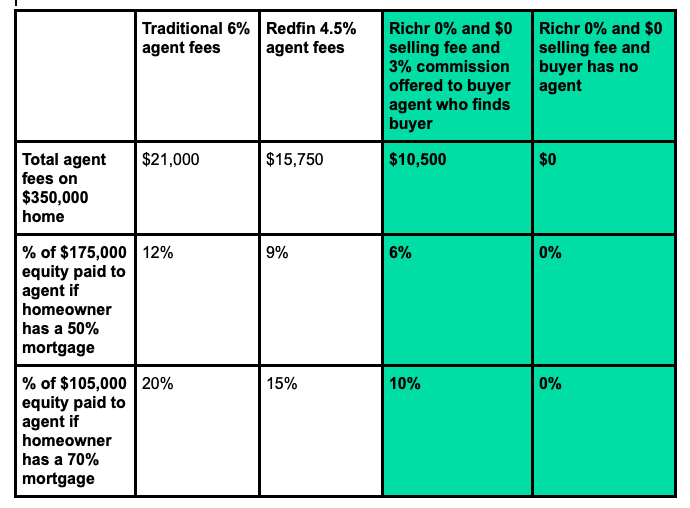

As the table below shows, for a $350,000 average priced home, 6% agent fees rack up to $21,000. For anyone with a 70% mortgage, that figure correlates to 20% of a sellers home-equity. Even for a seller with a 50% mortgage, $21,000 agent fees correlate to 12% of their home equity.

The deductions don’t stop with agent fees. There are other seller’s closing costs that chop down a seller’s equity even more. These include title searches, document prep fees, doc stamps, and prorated taxes.

If you can’t afford to give away so much of your home equity, use Richr to list your home, and keep the maximum equity you can. Fund your future.

If you want the Richr team to help you save thousands on your home just book a call.

Book a call

Book a call