Agent A-Team or Solo Superhero? Finding the Right Real Estate Partner for Your Selling Journey in Wildwood Florida

When it comes to selling your home in Wildwood, Florida,…

January 29, 2024

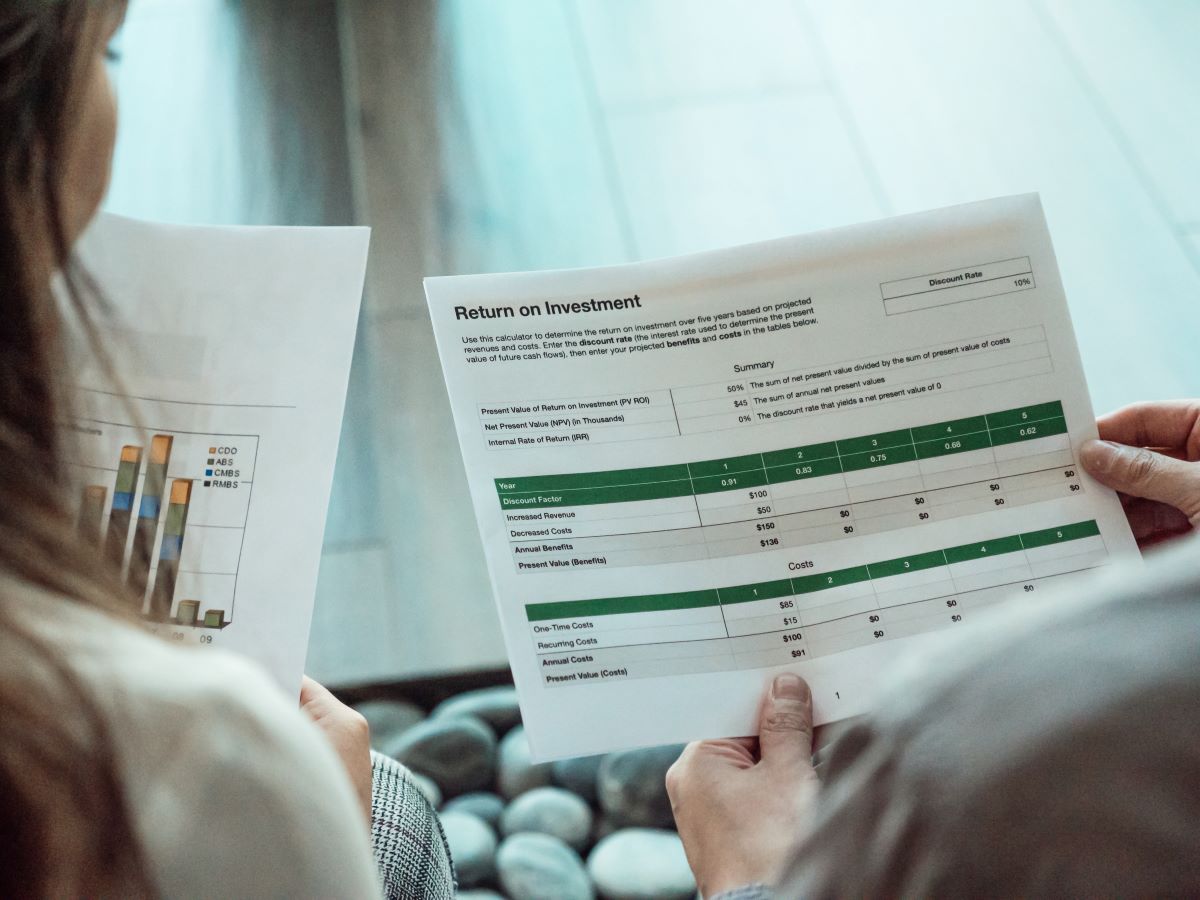

Selling your home is a significant milestone that often results in a sizeable sum of money entering your bank account. It’s an achievement to be proud of, but it also opens up an important question: What should you do with the proceeds from the sale? While some may be tempted to splurge or keep the money in a low-interest savings account, a far better approach lies in optimizing your financial future through smart investment decisions.

In this article, we will delve into the world of Exchange-Traded Funds (ETFs) and explore why they should be a crucial part of your investment portfolio after selling your home. Whether you’re a seasoned investor or new to the investment game, understanding the potential of ETFs can significantly impact your wealth-building journey.

After the euphoria of selling your home has settled, it’s time to ponder the next steps wisely. The key to a successful post-home sale investment lies in balance, diversification, and steady growth.

Before we explore why ETFs are an ideal investment choice post-home sale, let’s grasp the fundamentals. ETFs, or Exchange-Traded Funds, are a type of investment fund that trades on stock exchanges, much like individual stocks. They are designed to track the performance of an underlying index, sector, commodity, or basket of assets. The popularity of ETFs has surged in recent years due to their unique benefits.

Now that we’ve highlighted the benefits of ETFs, let’s explore some practical strategies to incorporate them into your investment portfolio:

The financial markets are no strangers to volatility, and post-home sale investors should be prepared for occasional fluctuations. ETFs can serve as an effective hedge against market volatility due to their diversification and index-tracking nature.

Selecting the right ETFs aligning with your investment objectives is crucial. Consider factors such as expense ratios, historical performance, asset allocation, and the fund’s adherence to its index.

Tax efficiency is a critical aspect of any investment strategy, and ETFs offer certain advantages that can boost your after-tax returns.

ETFs typically have lower turnover compared to actively managed funds, resulting in fewer capital gains distributions. This leads to potential tax savings for investors.

Tax-loss harvesting involves strategically selling investments at a loss to offset taxable gains in other areas of your portfolio. ETFs’ intraday tradability facilitates this strategy effectively.

Investing the proceeds from your home sale in ETFs can offer significant long-term growth potential, especially if you adhere to a disciplined and patient approach.

ETFs, combined with the power of compound interest, can help your wealth grow exponentially over time, providing financial security for the future.

ETFs can play a crucial role in retirement planning, helping you build a diversified and sustainable portfolio for your golden years.

No investment is entirely risk-free, but with thoughtful consideration and a diversified ETF portfolio, you can mitigate various risks.

Inverse ETFs can act as a hedge against declining markets, providing protection when your other investments may experience losses.

Leveraged ETFs amplify the returns of an underlying index but come with higher risks and may not be suitable for all investors.

Incorporating ETFs into your investment portfolio post-home sale can be a wise and rewarding decision. The diversification, liquidity, tax efficiency, and growth potential they offer align perfectly with your long-term financial goals. Remember to choose your ETFs thoughtfully, diversify across assets and sectors, and stay committed to your investment plan to reap the full benefits of these remarkable investment vehicles.

With ETFs, you have the opportunity to enhance your financial future and make your hard-earned money work harder for you.

Absolutely! ETFs are ideal for investors of all levels, including beginners. Their simplicity, diversification, and cost-effectiveness make them an attractive choice for anyone looking to start investing.

Yes, you can. ETFs allow you to invest with as little as the price of one share, making them accessible to investors with small amounts of money.

Yes, many ETFs pay dividends to investors. These dividends are typically distributed to shareholders periodically.

While ETFs offer diversification benefits, they are not entirely risk-free. However, they are generally considered safer than investing in individual stocks, especially if you invest in broad-market ETFs.

Yes, some ETFs are designed for short-selling, allowing investors to profit from declining markets. However, short-selling carries higher risks and may not be suitable for all investors.

If you want the Richr team to help you save thousands on your home just book a call.